How the price of eggs could boost some small-business contracts by 50%

Alaskan Native, tribal, and Native Hawaiian small businesses may soon be able to receive sole-source defense contracts up to $150 million, but it depends on an obscure inflation measure

One of the bigger stories in Federal contracting over the past five years has been the double-digit growth in contracting with Alaskan Native-owned, tribally owned, and Native Hawaiian-owned small businesses—what the industry refers to collectively as “entity-owned” businesses. A lot of that growth comes from unique authority that allows entity-owned businesses to receive sole-source contracts up to $100 million from the Department of Defense, if the contracts go through the 8(a) program. That $100 million level will soon increase 50% to $150 million, according to a little-noticed proposed rule that the Defense Department published the Friday before Inauguration Day. There’s just one problem: DoD’s math was wrong. But it might not matter because of the recent jump in egg prices.

The growth in contracting to ANCs, tribes, and NHOs

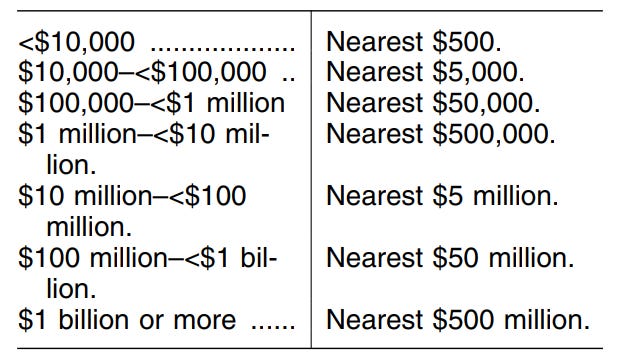

We’ve seen a boom in contracting to small businesses owned by Alaska Native Corporations, Indian tribes, and Native Hawaiian Organizations, so much so that those small businesses have come to dominate the 8(a) program. Here’s a graph through 2023—the most recent data in the Small Business Data Hub—showing that overall contracts to these entity-owned small businesses went from about $10 billion to nearly $25 billion in 7 years, with the biggest growth coming after 2020. (The 2024 figure is slightly over $26 billion.)

Much of the contracting to entity-owned small businesses goes through the 8(a) program, the small-business contracting program named for section 8(a) of the Small Business Act. One of the reasons is that, by law, entity-owned small businesses automatically qualify as “socially disadvantaged” for admission to the program; other firms have to prove that their owner suffered chronic discrimination. The other reason is the so-called sole-source threshold: most small businesses can get direct, non-competitive contracts through the 8(a) program worth up to $4.5 million. But entity-owned small businesses in the 8(a) program typically can receive sole-source contracts up to $25 million from civilian agencies and $100 million from the Defense Department. (NHOs are limited to the lower $4.5 million in civilian agencies, but still can get sole-source 8(a) contracts up to $100 million from DoD.)

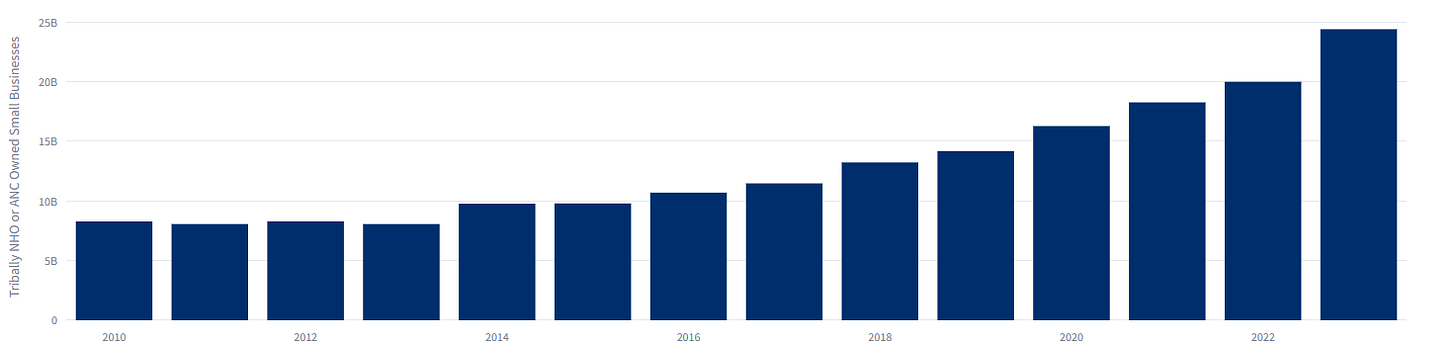

The difference in these dollar values has resulted in entity-owned small businesses accounting for more than half of contract dollars going through the 8(a) program, as shown in the following graph (the 2023 value here is 58%):

One quick note: Entity-owned small businesses are—in the eyes of the Federal government—small businesses, with all the benefits that come along with that status. But the entity-owned firms are allowed to get as much help as they want from their entity owners—the ANC, Indian Tribe, or NHO. And, if that owner has other successful businesses and lines of revenue, the entity-owned small businesses can take advantage of that success in a way that other small businesses can’t, either for legal or practical reasons.

DoD’s special $100 million authority

For small businesses that aren’t entity-owned, the sole-source threshold for 8(a) contracts is $4.5 million ($7 million if the contract is for manufactured products), meaning that the only way to get an 8(a) contract above that amount is through a competitive process. Officially, there isn’t a sole-source threshold for entity-owned small businesses in the 8(a) program. But there’s a paperwork problem if a government agency wants to award, say, a sole-source $1 billion contract to an ANC-owned firm: the law requires the agency buyer to prepare a justification, get the document approved at senior levels, and post it publicly. In operation, this paperwork requirement acts like a sole-source threshold because a lot of the benefit of using sole-source awards in the 8(a) program is speed, and getting this paperwork written and approved takes a lot of time.

The same law that created this paperwork rule also included exceptions to allow some sole-source 8(a) contracts to continue to be awarded quickly. The exceptions currently stand at $25 million for non-Defense agencies and $100 million for the Defense Department. One confusing aspect of these exceptions is that, if you were just to read the paperwork exception on its own, you would think that it applies to all 8(a) contracts. But, in actuality, because the sole-source threshold prevents most small businesses from getting sole-source 8(a) contracts above $4.5 million, the paperwork exception only gets used when the government awards a contract to a small business owned by an ANC, Indian Tribe, or NHO.

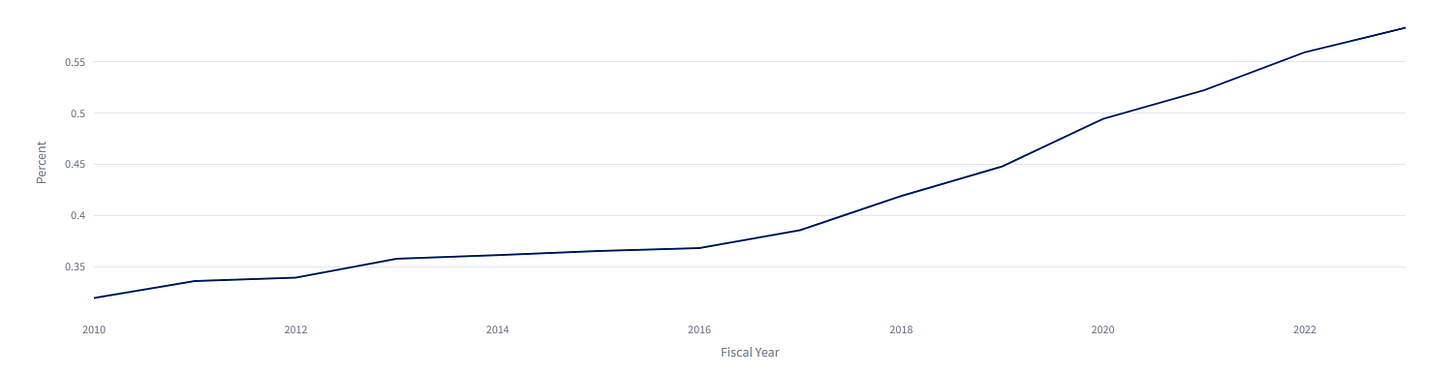

Congress passed the special $100 million exception for Defense contracts in late 2019, raising it from $22 million. DoD’s sole-source contracting with entity-owned small businesses has doubled since the $100 million exception went into effect:

DoD now spends over 70% of its 8(a) dollars with entity-owned small businesses, well above the government average. That’s mostly because of the special $100 million authority. And you would expect that, if that authority increased by 50%, entity-owned small businesses would get an even greater share.

The proposed increase to $150 billion

On January 17—the Friday before Inauguration Day—the Defense Department published a proposed change to its acquisition rules that, if finalized, would raise dollar values in those rules to account for recent inflation. These sorts of changes are strictly prescribed by law: The law requires these dollar values to increase every 5 years, specifies the inflation measure, and even instructs how to round the figures.

One of the biggest increases in the proposed change is to the $100 million authority for sole-source 8(a) contracts to entity-owned small businesses. DoD calculated that it should go to $150 million, a 50% increase, effective October 2025. I think DoD got the math wrong, but first I’ll explain how the inflation increase works.

If it weren’t for these inflation adjustments, acquisition rules would use the raw dollar figures that Congress designated in statute. The 8(a) sole-source threshold, for example, would be stuck at $3 million rather than the current $4.5 million. To account for inflation, the law requires regulators to increase the dollar amounts from time to time. In fact, a month before DoD published its proposed changes, the FAR Council proposed to increase that $4.5 million sole-source threshold in the 8(a) program to $5.5 million.

The inflation adjustments take place every 5 years, on the 5s and 10s, and are effective for the fiscal year that begins in October of that calendar year. So the 2020 increase became effective for Fiscal Year 2021, and the 2025 increase is targeted to go into effect for Fiscal Year 2026.

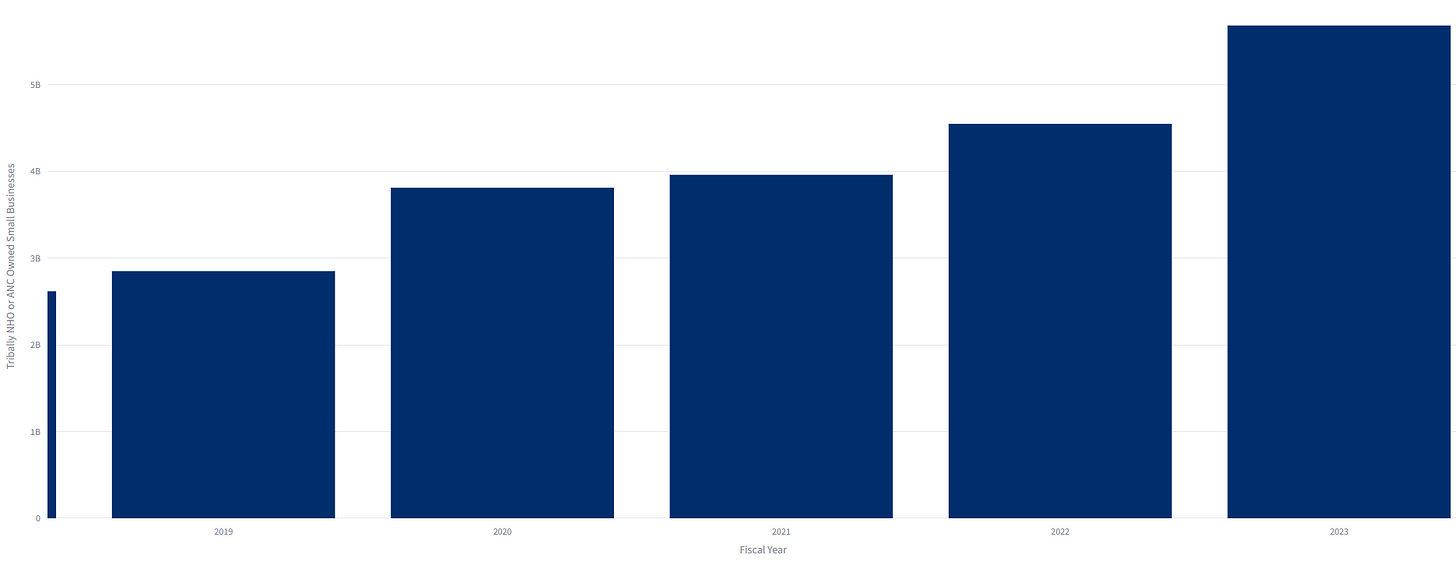

The law is very specific about the inflation measure and—somewhat oddly—the rounding process that results in the final dollar amount. The inflation measure is the monthly CPI-U (Consumer Price Index for all-urban consumers) issued by the Bureau of Labor Statistics. To calculate the final dollar amount, you apply the inflation measure to the statutory level and then round to the nearest amount allowed by the rounding rules. The rounding requirement is shown in this table from the Federal Register, with the range for calculated figures in the left column and the rounding rule in the right column:

Notice that there’s a sharp increase in the rounding rule at the $100 million dollar level. If the dollar level increases to, for example, $96 million before rounding, you round to the relatively close level of $95 million. That is because the rounding rule below $100 million is to round to the nearest $5 million. But things get strange at $100 million: every dollar value between $100 million and $124.9 million gets rounded down to $100 million, and every dollar value between $125 million and $174.9 million gets rounded to $150 million. Basically, the resulting value potentially deviates from the actual calculated value by a much larger amount when you get into the $100 million level and above (there aren’t any adjustable dollar values in the billions).

The Defense Department’s January 17 proposed rule explained that it used a CPI-U level of 323.193 for all the inflation increases, including that 50% increase to the $100 million authority for 8(a) sole-source contracts to entity-owned small businesses. Increasing that authority to $150 million would boost 8(a) contracting to those ANC-, Indian Tribe-, and NHO-owned firms, potentially crowding out prime contracting for other small businesses at that level (the agency might use a sole-source contract to an entity-owned business whereas it might previously have competed the contract) while also creating more subcontracting opportunities for non-entity-owned firms.

A math mistake?

Here’s the thing: the inflation measure that DoD used in its proposed change was not the actual inflation level. The official CPI-U inflation level in January 2025 was 317.671, meaning consumer prices were 3.17 times the prices in the baseline period of 1982-1984. (Something that cost $1 in 1983 would cost $3.17 today.) The proposed change used a projected CPI-U level for March 2025 that was 6 points higher, 323.193.

Using the projected level rather than the actual level makes all the difference for the sole-source authority. Because of the strange rounding rules, the $100 million must stay at $100 million if inflation between 2019 (when the $100 million was enacted in law) and today is anything less than 25%. If inflation is even a hair above 25%, the authority jumps to the next permissible level of $150 million.

The official CPI-U level for December 2019 was 256.974, according to a document that DoD published to accompany its proposal. That means that, to move the $100 million value to $150 million, the new CPI-U level needs to be at least 25% more, or at least 321.218.

DoD used a projected March 2025 CPI-U inflation level of 323.193, more than enough to raise the sole-source authority. But, at the time that DoD published its proposed change in January, the CPI-U level hadn’t reached 321.218. It was just 317.7. And DoD’s projection proved to be incorrect: The actual March 2025 CPI-U came in at 319.8. That’s still too low to justify increasing the $100 million authority.

I’m not sure where DoD got the projected March 2025 CPI-U, or why March is the right date when you’re publishing the proposed changes in January. My best guess is that DoD wanted to be consistent with the projected CPI-U level that the FAR Council used in its proposed increases from November 2024. And the FAR Council used March as the date because it had used March in the past two inflation increases in 2015 and 2020. To project out to March 2025, the FAR Council probably estimated inflation to March 2025 based on recent trends. It overshot because prices leveled out in early 2025.

All this is to say that, had DoD used the actual January 2025 inflation level—or even the eventual March 2025 level—it wouldn’t have touched the $100 million sole-source authority for entity-owned small businesses. We wouldn’t be talking about a 50% jump and the potential big shift in small-business contracting.

(In case you were wondering, this analysis does not extend to the increase to the sole-source threshold for 8(a) firms not owned by ANCs and Indian tribes. The FAR Council proposed increasing that from $4.5 million to $5.5 million. To justify that increase, the CPI-U level needs to be at least 308.2, and the actual level is well above that figure.)

Why the authority still can go to $150 million

Despite overshooting the actual March inflation level, DoD still may have reason to go ahead with increasing the $100 million sole-source authority to $150 million. It’s because of eggs. BLS reported that the inflation level for May 2025 was 321.465, with the increase driven by a 6% year-over-year increase in meats, poultry, fish, and—of course—eggs. That value is above the 321.218 level required to increase the sole-source figure. But remember that the final adjustments to the acquisition rules aren’t scheduled until October. By then—since deflation is unprecedented in the modern United States—the inflation level will be safely above the trigger level. The DoD will be able to justify finalizing the proposed $150 million level.

Another possibility is that inflation increases—which have been automatic in the past—will get caught up in the regulatory freeze. The Defense Acquisition Regulatory Council hasn’t published a single regulatory change since Inauguration Day. The Council’s working list is filled with a lot of “case on hold” and “report due date extended” comments. It remains to be seen whether these inflation adjustments, and the DoD sole-source authority in particular, can get pushed through. If they do, prepare to see more entity-owned contracting in 2026, continuing a trend that already has transformed the 8(a) program. And all because of the price of eggs.

Sam Le writes GovCon Intelligence, an educational and informational resource, in his personal capacity, without affiliation with the U.S. Government or the Small Business Administration. This post does not divulge any non-public information, nor does it discuss matters pending before the Small Business Administration.