Something weird is going on with the 8(a) program. Most affected are firms owned by ANCs, Tribes, and NHOs.

The latest data on approvals and a review of the history behind Native contracting

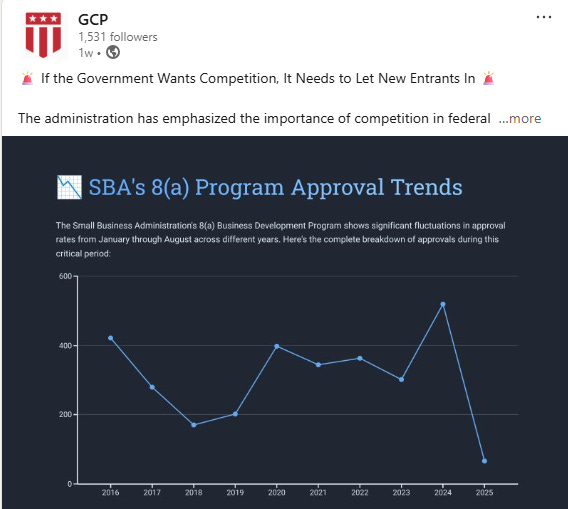

Last week, GovContract Pros published data showing that SBA’s 8(a) program approvals are down to their lowest level in 10 years. And not just by a little bit. According to GCP, only 66 firms have been approved for the 8(a) program since January. At this time last year, over 500 firms had been approved.

I’m impressed by GCP’s data, and not just because it adds more support to the notion that SBA is pulling away support for the 8(a) program. This is not the only evidence. SBA has issued four recent public announcements that negatively affect the 8(a) program:

ordering a full-scale audit of the 8(a) program;

issuing a formal letter to contracting officers about oversight of 8(a) fraud;

rescinding 8(a) contracting authority for USAID; and

reinstituting the “bona fide place of business” rule, which requires that 8(a) construction contracts be performed by local contractors.

Now, with the GCP data, we get a look behind the scenes at SBA’s certification process. What we find there is that 8(a) applications are barely moving.

With origins as the “Minority Small Business and Capital Ownership Development” program, the 8(a) program is historically associated with affirmative-action initiatives. But the Clinton Administration changed the name, and the Biden Administration ended the preference for minority applicants. So now, regardless of race, applicants need to complete a narrative to justify their eligibility as disadvantaged.

Is GCP’s data showing that SBA is rejecting 8(a) applications based on the narrative? If that were the case, though, you would see more appeals of denials of 8(a) applications. The published appeals only show that SBA’s electronic system is glitching and emailing out draft documents.

I don’t have the underlying data to test that theory. To get their stats, GCP probably had to download certification data every month for the past ten years. That’s very impressive. By comparison, I’ve been downloading data for four-and-a-half months, ever since coming up with the idea for this newsletter.

From my recent data, I can show that the 8(a) program is dramatically behind the other certification programs in growth over the past five months. SBA has grown every program in that period, except for 8(a). The service-disabled veteran-owned program has grown by 13.5%—leading all others—while the 8(a) program has shrunk by over 6%.

Granted, you wouldn’t expect the 8(a) program to grow at the same rate. Participants in the program are limited to 9 years, so companies are graduating from the program every day. That’s not the case for the other three programs. In those, SBA only removes companies for noncompliance or failure to file renewals. But that doesn’t mean the 8(a) program should be as far behind as it is. In past years, SBA has approved enough 8(a) participants to at least fill in the spots left by graduating firms. That’s clearly not the case recently.

The history and legal basis for Native 8(a) participation

An interesting twist on this story is that SBA’s shift on the 8(a) program affects not only traditional 8(a) firms owned by entrepreneurs, but also native communities. These are the Alaska Native Corporations, Indian tribes, and Native Hawaiian Organizations that participate in the 8(a) program by special legal authority. I’ll dive into the data below; it’s actually the case that those native organizations are the biggest part of the 8(a) program—at least by dollar amount. So, if SBA is going to withdraw support for the 8(a) program, that is going to have the biggest effect on native-entity participants.

Before going into the data, I’ll quickly go through the history of the legal changes that led to the current level of native 8(a) participation. That history divides well into three eras: Participation through sole-sourcing, a sole-source pull-back, and, more recently, expanded sole-source authority.

Through discussions in Congress, these special authorities for Alaska Native Corporations, Indian tribes, and Native Hawaiian Organizations were enacted to recognize their special responsibility to their native communities. The revenue earned through 8(a) contracting can flow to thousands of shareholders, tribal members, or community members, many of whom live in substandard conditions.

Participation through sole-sourcing

1971 - The Alaska Native Claims Settlement Act creates Alaska Native Corporations to manage resources for Alaska Native communities.

1986 - Amendments to the Small Business Act make businesses owned by ANCs and Indian tribes eligible for the 8(a) program.

1988 - Statutory revisions to the 8(a) program exempt ANCs and Indian tribes from 8(a) sole-source thresholds, and recognize businesses owned by Native Hawaiian Organizations as eligible for the 8(a) program.

1992 - Revisions to ANCSA deem ANCs economically disadvantaged for the 8(a) program.

2003 to 2005 - Various DoD Appropriations Acts exempt NHOs from 8(a) sole-source thresholds for Defense contracts. NHOs still are subject to the thresholds for civilian-agency contracts.

Sole-source pullback

2009 - The NDAA for FY 2010 imposed a per-contract cap on sole-source awards to ANC-, Tribally, and NHO-owned 8(a) participants. Above the cap—initially set at $20 million—agencies needed to complete justifications and get those approved.

Expanded sole-source authority

2019 - The NDAA for FY 2020 creates new authority for $100 million sole-source 8(a) awards to ANC-, Tribally, and NHO-owned firms without requiring a justification.

Because of these legislative enactments, the no-justification sole-source authority for 8(a) participants owned by ANCs and Indian tribes goes up to $25 million for civilian agencies ($30 million starting Oct. 1) and up to $100 million for Defense agencies. Other 8(a) firms generally are limited to $4.5 million sole-source awards, or $7 million for manufacturing contracts ($5.5 million and $8.5 million for manufacturing, as of Oct. 1). NHO-owned 8(a) firms have split authority; they can receive sole-source contracts up to $100 million from Defense agencies, but are limited to the lower general thresholds at civilian agencies.

Using regulations to implement the legislative authorities, SBA has created differences between firms owned by Native entities and those owned by individual entrepreneurs. Native-owned firms are deemed to be socially disadvantaged and receive exceptions to affiliation. The Native entities are exempt from SBA’s one-time eligibility rule and therefore can own multiple 8(a) firms simultaneously. The entity-owned firms also have additional responsibilities that individual-owned firms don’t have, however. They must file community benefits reports and are restricted from receiving certain follow-on sole-source contracts.

Where Native 8(a) contracting stands today

Using data from SBA’s Datahub, I collected data on the effect of those legislative enactments. The Datahub only goes back to 2010, not to the start of the 1971 timeline.

You can clearly see the effect of the 2010 caps in year-over-year decreases in 8(a) contracting to the Native entity-owned firms. And, after the new $100 million Defense sole-source authority went into effect in 2020, the entity-owned firms have doubled their 8(a) contracts through 2024.

That steep increase in 8(a) contracts to Native-entity firms has led to where we are today: Over 60% of 8(a) contract dollars flow to ANC-, Tribally, or NHO-owned firms. People are often surprised that over half of 8(a) contract dollars go to entity-owned firms. But it’s been that way since 2021:

This shouldn’t discourage any business owner from participating in the 8(a) program. Over $25 billion in contracts go through the 8(a) program every year. So, even with 63% going to native-entity firms, the remaining 37% still accounts for $9 billion. That $9 billion is split among thousands of businesses, considering that the 8(a) program caps business owners from making more than $400,000 in adjusted gross income. This means thousands of entrepreneurs use the 8(a) program as a springboard to a lucrative government-contracting business.

One successful category of 8(a) businesses is veteran-owned firms. Veteran-owned businesses receive 9% of 8(a) contract dollars. That means that 72% of 8(a) contract dollars go to businesses owned by Alaska Native Corporations, Indian Tribes, Native Hawaiian Organizations, or veterans. Those are the groups that are really losing out as SBA slows down 8(a) processing.

Please join Christine Williams of Outlook Law and me at 2 p.m. ET today for a webinar discussion about these Native contracting issues and about the FAR Overhaul. Christine is a vice-chair on the American Bar Association Small Business Committee. Join through Outlook Law’s website or click here at 2 p.m. ET:

Sam Le is the managing member of Sam Le Law, where he draws on his 20 years of Federal legal experience and deep knowledge of SBA programs to counsel small businesses through complex regulatory challenges. His website is www.samlelaw.com.

Sam; As you know, the history of the 8a program is long and interesting, one little known part was the press announcement in 1972 by the SBA Administrator with the VA Administrator that Vietnam Era and Disabled veteran small businesses were to become eligible for 8a program participation. SBA implementation lagged, but historically, veterans have always been part of the 8a program, based on their eligibility other than their unique federal status as veterans.

No disagreement with your queries here about "what is going on?" except that I'm glad the bona fide office rule returned (what you mentioned here as negatively inpactimg the program: "reinstituting the “bona fide place of business” rule, which requires that 8(a) construction contracts be performed by local contractors") because it was changed to benefit the larger 8(a)s that are already getting the most benefit anyway. Meaning, it only further hurt individually-owned firms who can't fairly compete with Native owned firms (the larger 8(a)s).