HUBZone contracts are at their lowest in 6 years. Here's what firms should do.

There are some bright spots for HUBZone program as we get to the last quarter of the Fiscal Year

This article has a lot of graphs. If you’re reading on email, click “Display images” above to see the graphs.

The National HUBZone Conference starts tomorrow. I’m speaking on Thursday at 1:30 p.m. and will try to broadcast live at govconintelligence.com. One of the hot topics will surely be whether the costs of complying with the requirements of the HUBZone program are worth the benefits that companies get. To get admitted to the program and continue to qualify, firms must meet three requirements: (1) have at least 35% of their employees residing in Historically Underutilized Business Zones, (2) have their principal office located in a HUBZone, and (3) be at least 51% owned by U.S. citizens.

The 35% residency requirement is the most onerous of those requirements because a firm’s employees come and go. If a HUBZone-residing employee leaves, and that drops the firm below the 35% threshold, then the firm has to quickly hire another HUBZone resident to stay compliant. With larger companies, that can become very hard to track.

The benefit of the program is that agencies prioritize awards to HUBZone firms in order to meet the government’s goal of awarding at least 3% of total prime and subcontract contract dollars to program participants. But the government has never met the 3% goal. Last year, HUBZone prime awards made it to 2.75%, down slightly from the prior year. That amounts to about $17 billion in awards to HUBZone businesses.

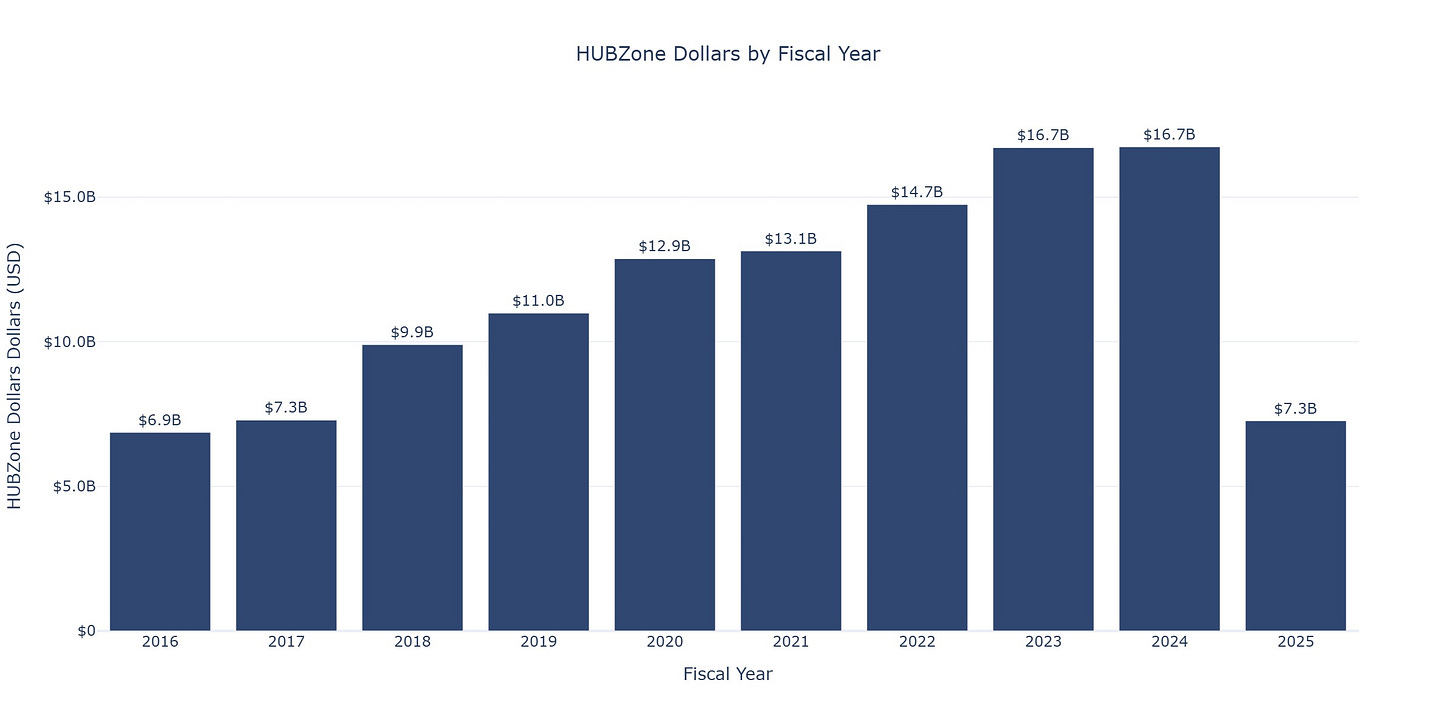

HUBZone dollars by year

So far in Fiscal Year 2025, agencies have awarded about $7 billion to HUBZone firms. Here is the graph showing the current fiscal year’s HUBZone awards compared to the awards at the end of prior fiscal years1:

There’s a big caution and caveat here that current year figures that I report here—and whenever I report figures—don’t include all Department of Defense data to the current date. DoD data is embargoed for the public for 90 days. So the figures in this article include civilian-agency data through July 18, but DoD data only through April 19.

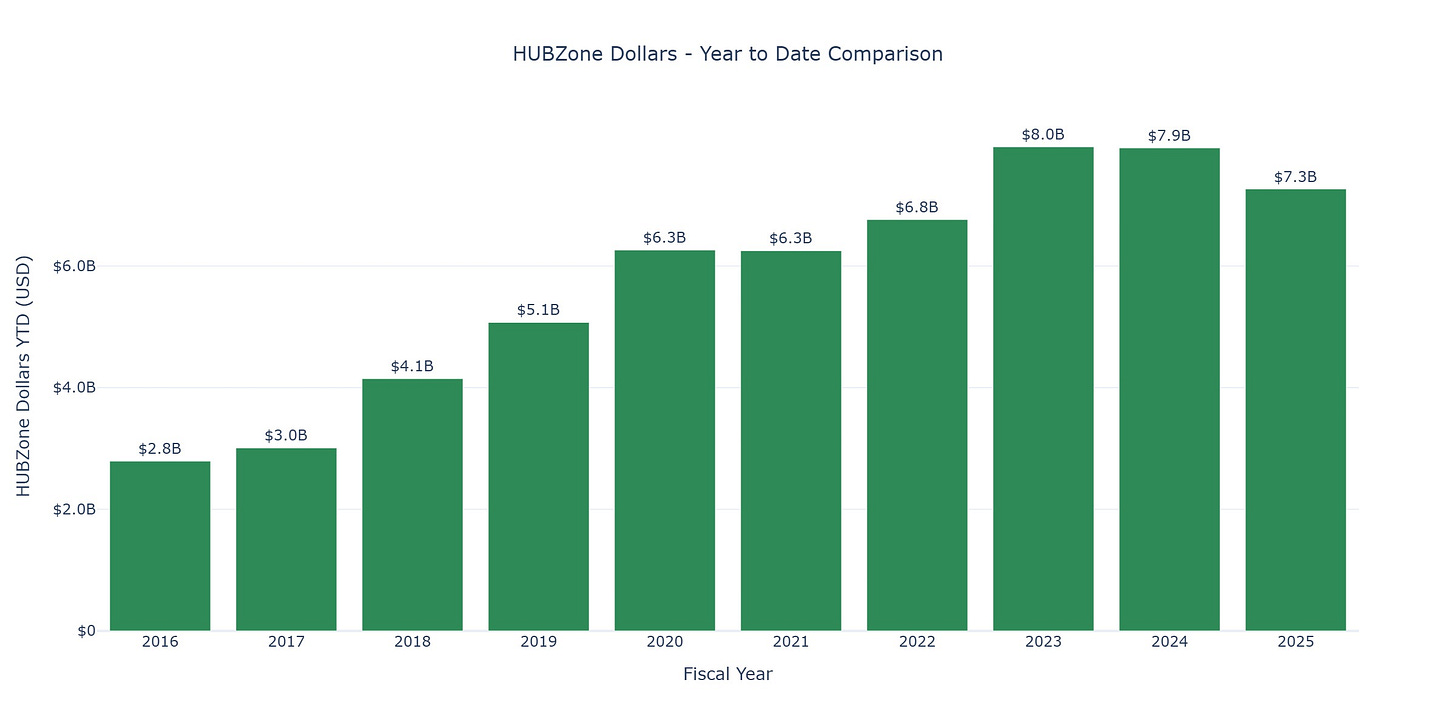

The graph above shows the government being $10 billion behind last year, but it’s not really fair to compare 2025 to date with full fiscal years. So I’ve adjusted all the prior fiscal years to match the time period for the 2025 data (July 18 for civilian, April 19 for DoD). The adjusted graph shows the government being only about a half-billion behind last year’s pace. And, in fact, awards to HUBZone firms are outpacing every year before 2023:

Even more than the 3% goal, though, the big benefits of the HUBZone program are three specific contract preferences that HUBZone firms receive. First, HUBZone firms can qualify for HUBZone set-asides, meaning contracts that are reserved only for HUBZone firms. Second, HUBZone firms can receive sole-source awards below a $4.5 million threshold (higher for manufacturing). Third, HUBZone firms receive a 10% price-evaluation preference when offering on full-and-open competitions.

Zooming in on HUBZone preferences

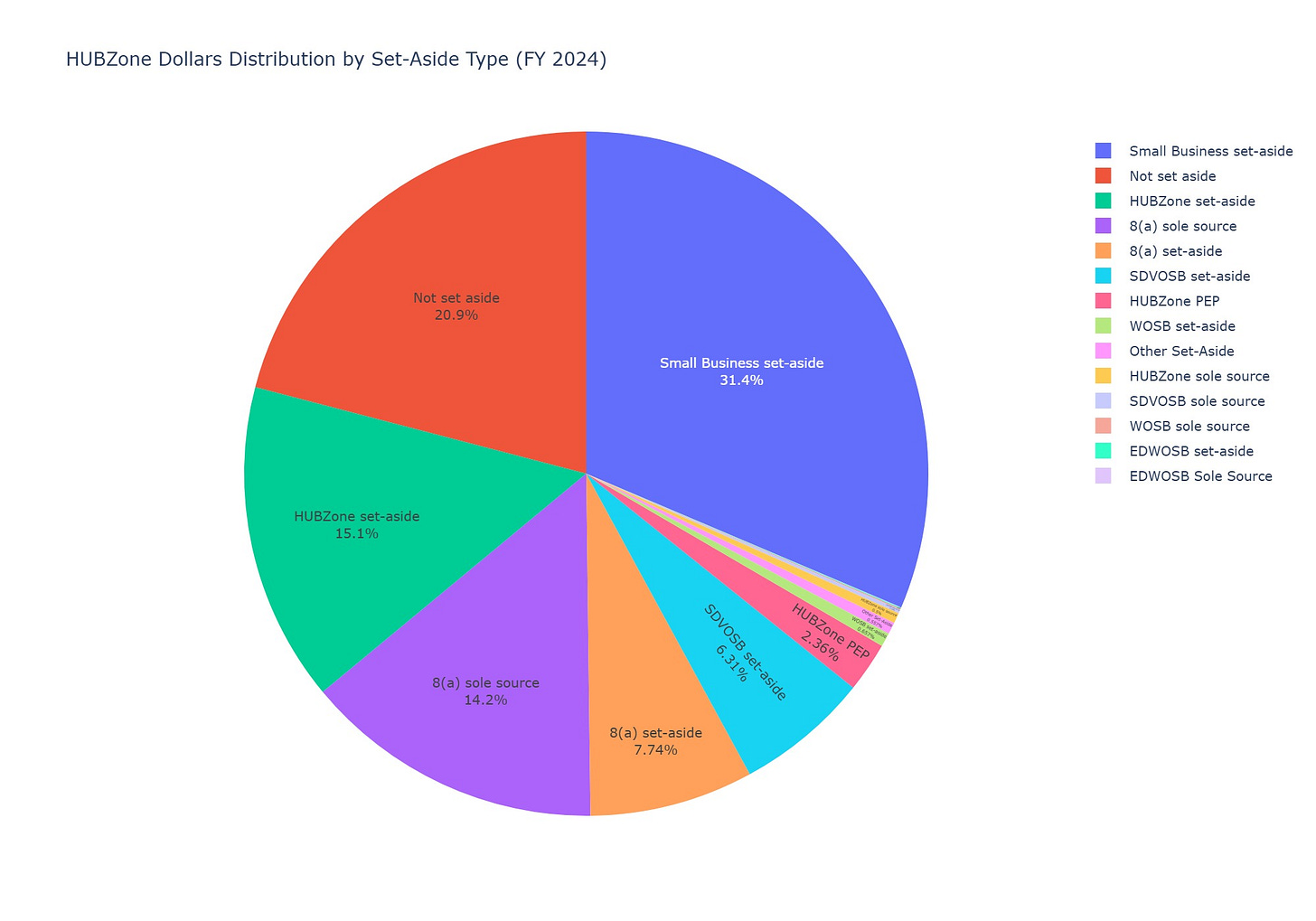

So, while the graphs above are interesting—and it’s what SBA reports on its scorecard—what HUBZone firms really need to care about to evaluate the benefit of the program is how many contracts use those three preferences. HUBZone set-asides are actually a very small portion of the HUBZone dollars reported above. Here’s a pie graph showing how that $17 billion to HUBZone firms in 2024 breaks down by set-aside category:

Over 50% of HUBZone dollars are awarded through regular small business set-asides (31%) or through open competition (20%). I tried to separate out the price evaluation preference in the graph, but I suspect some of the dollars through open competition actually use the preference and just didn’t report it. Either way, normal HUBZone set-asides accounted for only 15% of the HUBZone dollars. HUBZone sole-source awards are minuscule, only $83 million, or 0.5% of the dollars going to HUBZone firms.

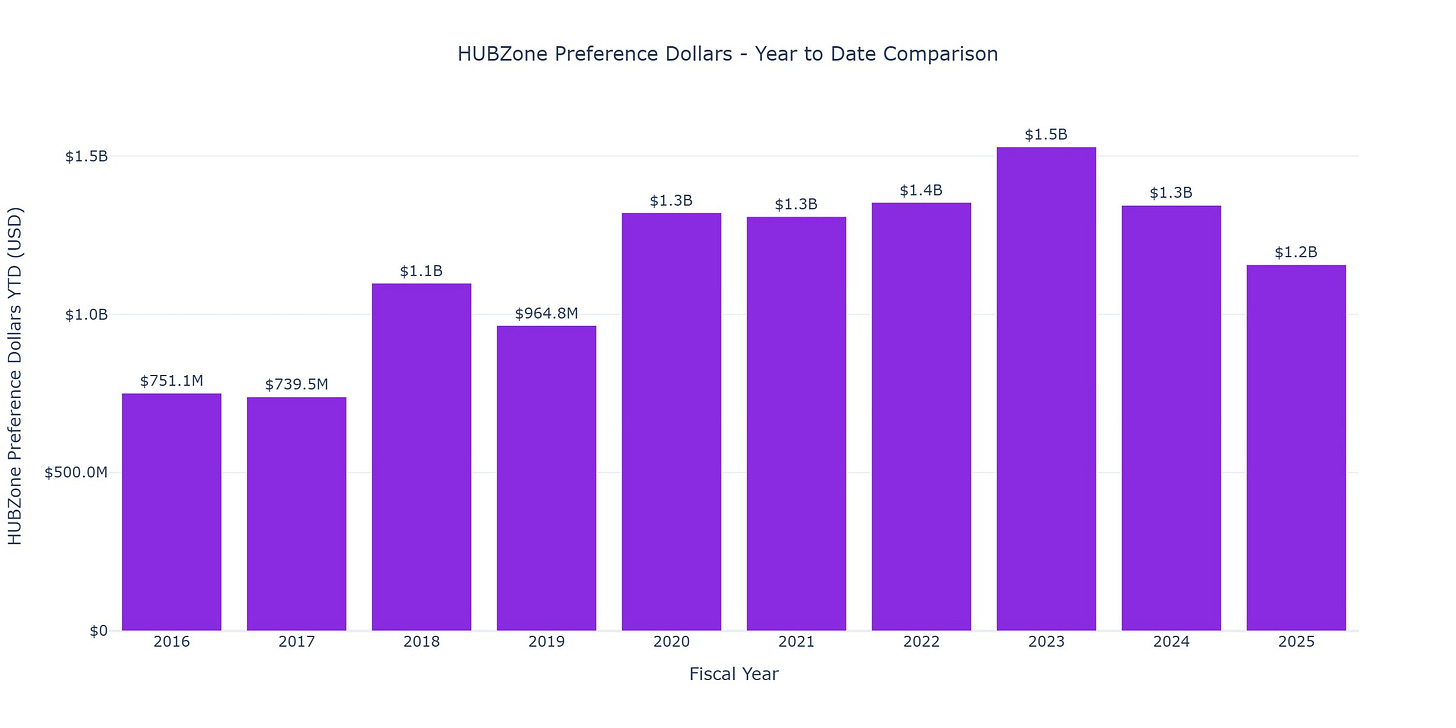

The SBA reported on its scorecard that HUBZone set-asides accounted for only 0.44% of Federal contracting in 2024, or $2.8 billion. Those are really small numbers (but not the smallest—women-owned small business set-asides account for even less). For my purposes of evaluating the value of the HUBZone program, I added in the price evaluation preference into what SBA calculated to get $3.2 billion in HUBZone preference dollars. Here are HUBZone Preference dollars by fiscal year; remember that this compares the current 2025 to the prior full fiscal years:

Again, it’s not fair to compare mid-year 2025 to prior years, so I’ve adjusted the prior years for July 18 civilian/April 19 DoD. The result shows that HUBZone preference dollars are down from where they were last year—$1.2 billion in 2025 versus $1.3 billion last year. That’s the lowest in six years:

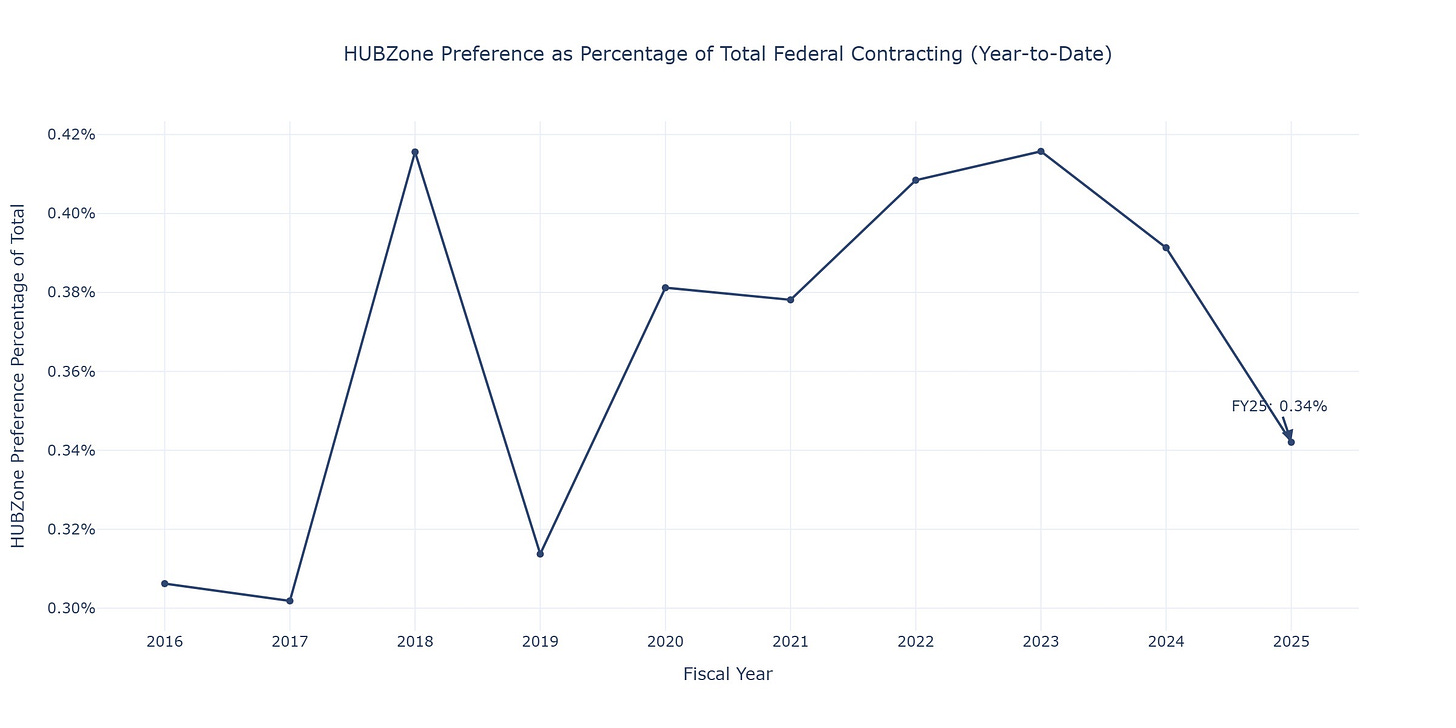

The percentage of HUBZone preference awards out of all Federal contracting is still really low, just 0.34% of contracting dollars. That is the lowest at this point in the Fiscal Year since 2019:

Dollars by agencies, industry, and company

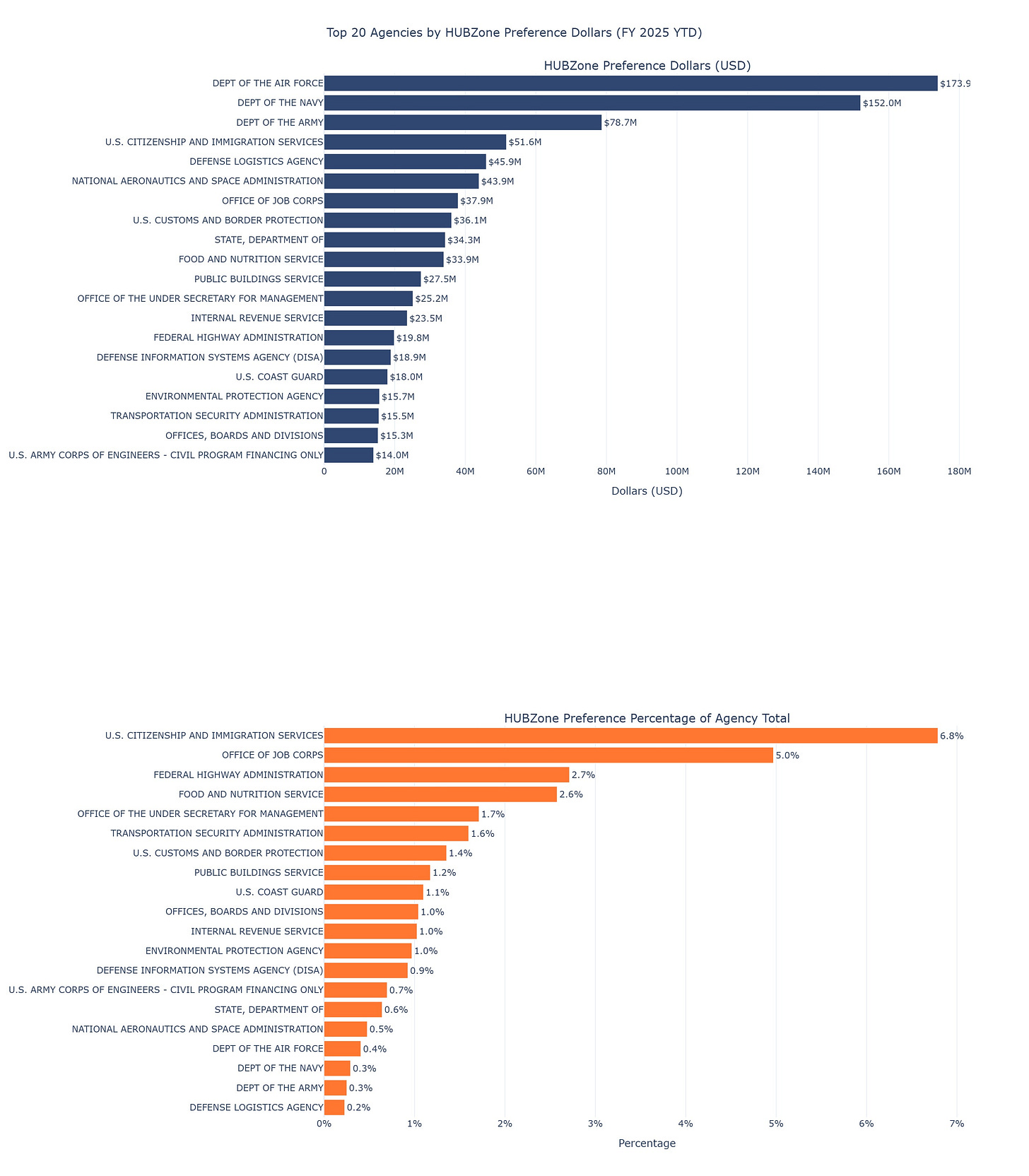

These figures are for the full Federal government. When you look at individual agencies, the Air Force really stands out for its use of HUBZone preferences so far in Fiscal Year 2025—even though its data only goes through mid-April. Among civilian agencies, USCIS, NASA, and the Department of Labor’s Job Corps program are really high on the list. These graphs show the top agencies for using the HUBZone preferences, both by dollar amount and by percentage of their total spend2:

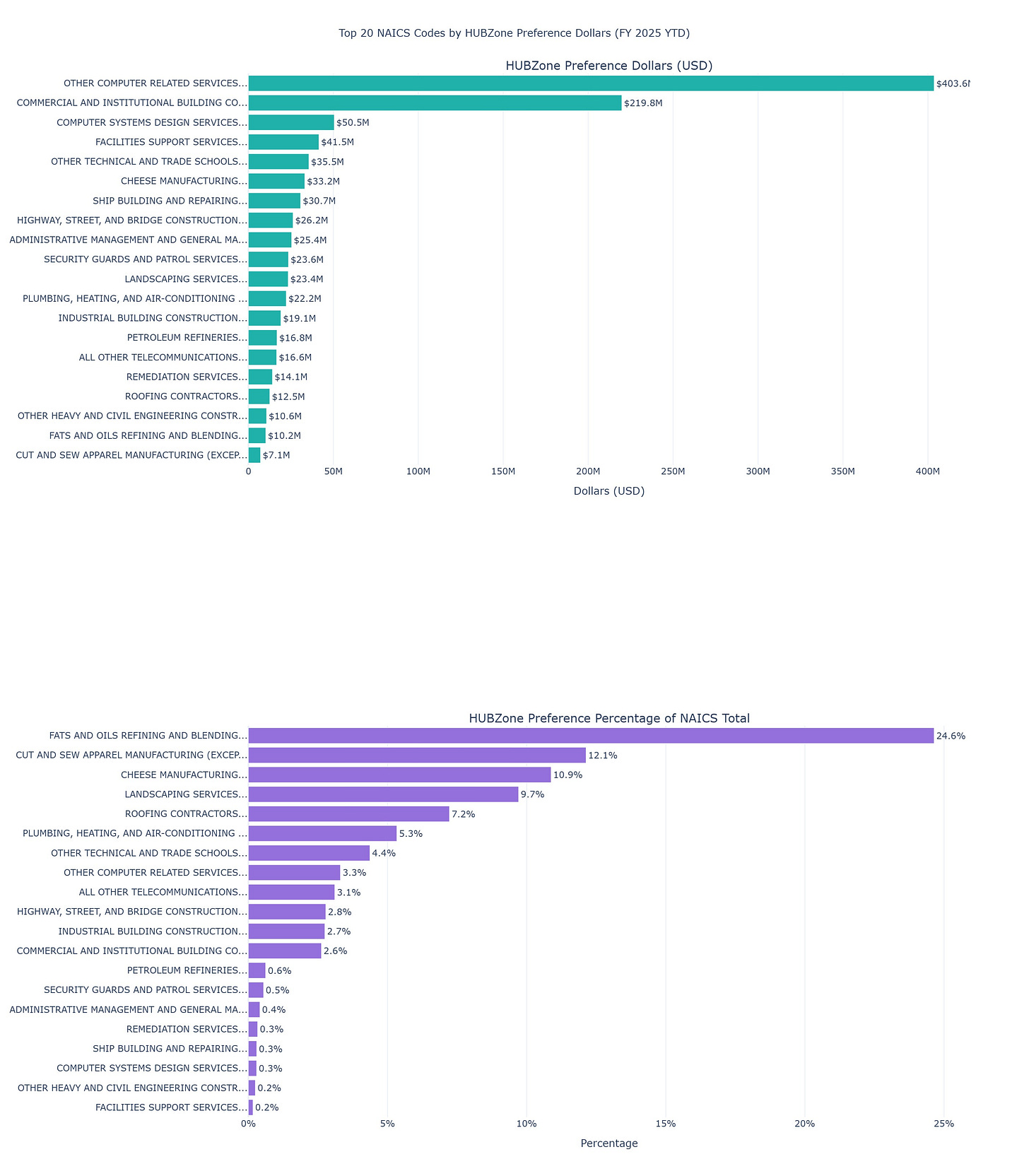

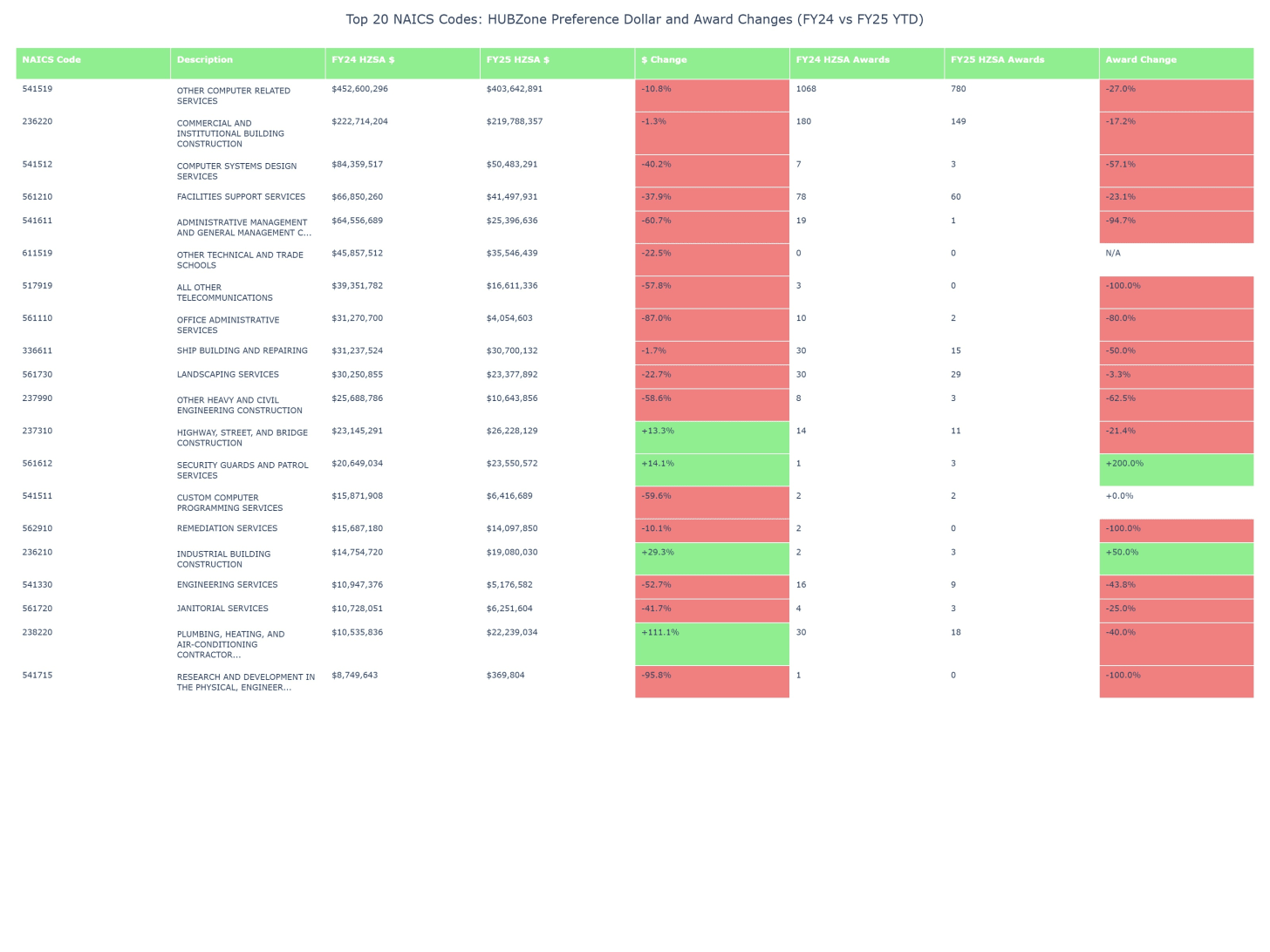

I also broke down the 2025 data by NAICS codes. Two IT services NAICS show up in the top three, joined by commercial construction. And, somehow, HUBZone firms are dominating the Federal government’s cheese production—I’ll have to check whether that’s a Wisconsin HUBZone business. Here are the top NAICS codes for use of the HUBZone preferences, both by dollars and percentage of total spend in that NAICS:

So far in 2025, a single HUBZone in California, Blue Tech Inc., is absolutely dominating the HUBZone set-aside awards. Blue Tech has more than a quarter of all HUBZone preference dollars, or $308 million. Here are the rest of the top 25 firms in winning HUBZone preference dollars for FY2025:

New HUBZone awards

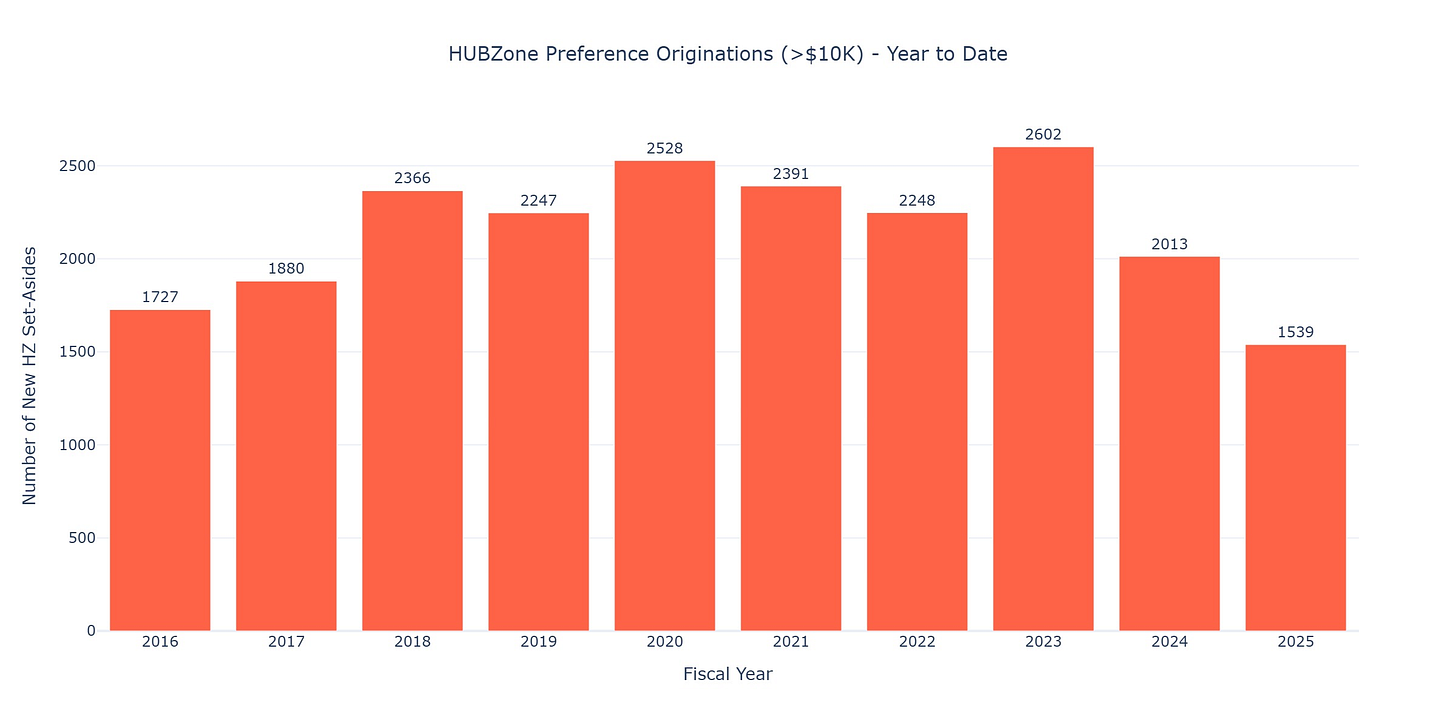

So far in this deep-dive, the HUBZone numbers are on the low side but nothing to be alarmed about—unless you were expecting that the HUBZone program would surge in 2025. Where does all the tumult in 2025’s contracting world show up? The effect of new policy shifts starts to appear when I look at new HUBZone awards in 2025. All the figures thus far have been dollars being spent on existing awards. New HUBZone awards are way down in 2025 from prior fiscal years at this time. The following graph looks at the number of new awards (what I call “originations”) using the HUBZone preferences that exceed the micropurchase threshold of $10,000:

There have been only 1,539 new HUBZone preference awards in 2025, down over 20% from last year at this time (and down 40% from 2023). There are over 4,500 HUBZone firms, so this is about one new award for every three HUBZone firms.

Is it possible that there are fewer new awards, but they are each larger? The data contradicts that. The new awards (excluding multiple-award contracts, which get double-counted otherwise) sum to only $1 billion in total contract value, the lowest to this point over the past 10 years:

This data seems dire: new HUBZone awards are down 25%, and the value of those awards is down too. There are some bright spots, however. Though a lot of agencies have reduced their HUBZone preference contracting, a few are awarding more through the program. HUBZone firms should concentrate on these more frequent users of the program.

Similarly, some industries are showing bright spots, despite the overall decrease. Plumbing and HVAC has a 111% increase from last year:

HUBZone firms that are struggling to find set-aside opportunities will want to review this data to see if they might be able to shift their focus into related agencies or industries where HUBZone preferences are still flowing. Also, the 3% subcontracting goal still is in place, and primes struggle to find HUBZone subcontractors. So there may be new opportunities opening up in subcontracting to make up for the decrease in prime contracts to HUBZone. Please leave a comment below if you see other opportunities for HUBZone firms.

Sam Le is a Virginia- and D.C.-licensed attorney. His website is www.samlelaw.com.

The values for prior fiscal years don’t match up exactly with the SBA scorecard, mostly because of an upward adjustment that SBA makes for the Department of Energy. I also don’t have access anymore to SBA’s underlying data, so there may be some slight differences between what’s

The “Office, Boards, and Divisions” on the first graph is a component of the Department of Justice.

Love this deep dive! Thanks for the deep analysis!