The latest SBA Scorecard comes from a world that no longer exists

The release of the 2024 small-business procurement scorecard emphasizes just how different 2025 is

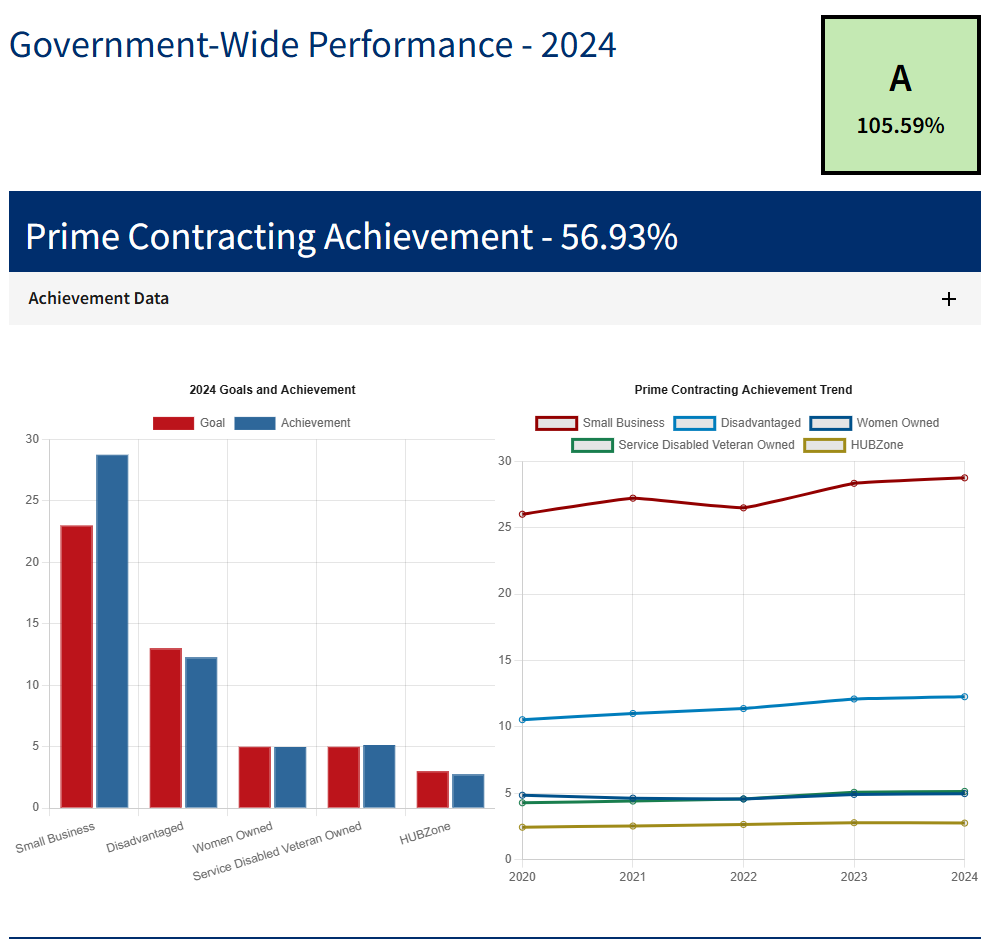

Reading the Small Business Administration’s 2024 small business procurement scorecard—which SBA published yesterday—feels like entering a time machine. The scorecard returns you to the days of high disadvantaged business goals, industrial-base growth strategies, and increasing set-asides for small businesses. We don’t live in that world anymore. So this scorecard (the fourth and last one I worked on as SBA procurement policy director) is more of an acknowledgment of past practices than an indicator of what might happen in the future.1 Nevertheless, the scorecard contains useful and intriguing policy insights.

Treasury’s big win, how goals drive participation, and new data

SBA usually does some press around the release of the scorecard, but this year they decided to publish a news release in January (pre-Inauguration) with the top-line figure: $183 billion in contracts went to small businesses in 2024, or 28.78%—both new records. Then SBA released the actual scorecard yesterday with no fanfare. So I dug into the scorecard site to pull out the top three details.

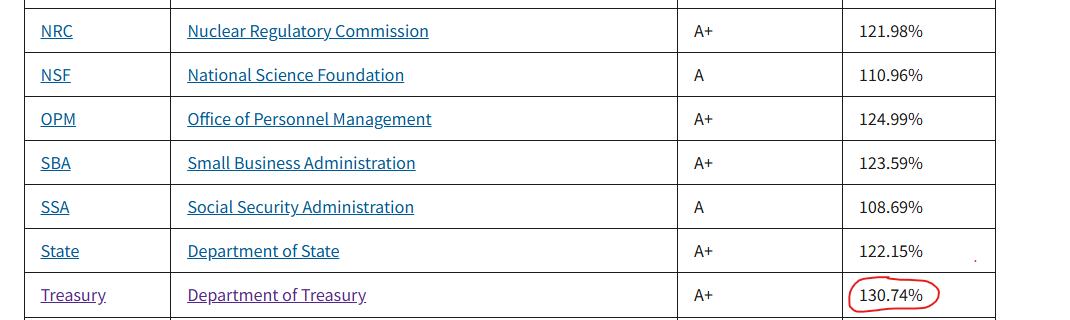

First, congratulations to the Department of the Treasury for getting the overall top score. Treasury is the fourth different scorecard champion in four years, joining Commerce, HUD, and OPM. Treasury did it by almost doubling their spending with service-disabled veteran-owned firms and by boosting subcontracts with small businesses overall. The people most responsible for Treasury’s triumph, senior procurement executive Nicole Evans and OSDBU director Donna Ragucci, aren’t with the agency anymore. So they can say they left government service on top à la John Elway. If you’re working on Treasury projects, it’s worth reading the agency’s scorecard comments, which emphasize how the new OSDBU will rely on AI and bots for market research. Make sure your capability statement is ready for that.

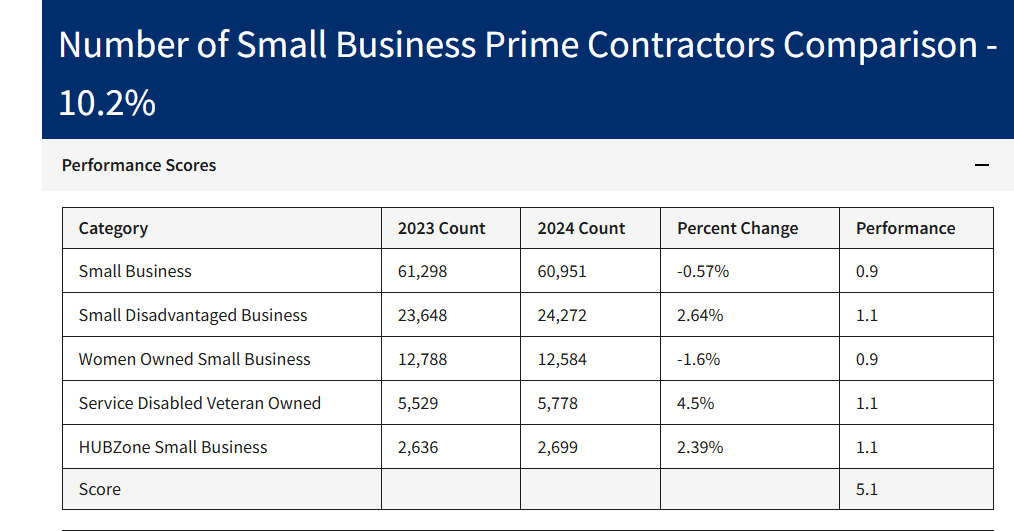

Second, this scorecard shows how goals drive growth in small-business participation. SBA increased two goals in 2024: the goal for small disadvantaged businesses went from 13% to 15%, and the goal for service-disabled veteran-owned small businesses went from 3% to 5%. Both those areas experienced growth in small-business participation. The number of SDB vendors increased 2.6%, and SDVOSB vendors went up 4.5%. Increases in those areas buck the overall trend of declining small business participation, as well as an overall decrease for 2024 of a modest 0.5%. Clearly, higher goals boost the small-business industrial base. That could be a long-term solution to address concerns about the shrinking number of small-business vendors.

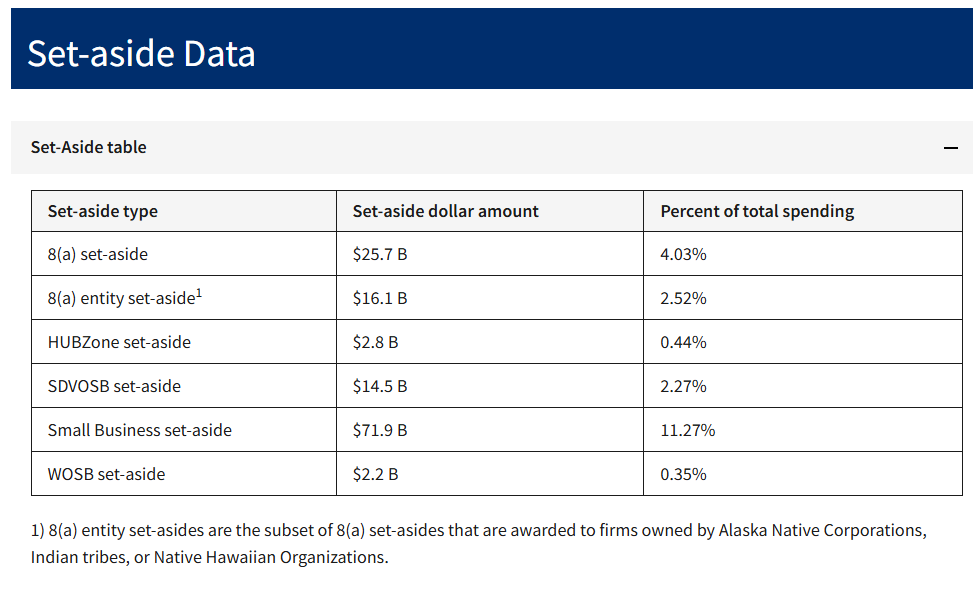

And third, the 2024 scorecard includes new data on set-aside dollars, showing that you don’t need to be SBA-certified to win contracts. Governmentwide, small business set-asides account for the largest proportion of set-aside type (11.3%). That’s more than all the other set-aside types combined. Small business set-asides also were the area with the most growth: up $3 billion from 2023 to 2024. To qualify for a small business set-aside, the business only needs to self-certify its size and affiliation. It doesn’t require an SBA application. Yes, there are a lot more small businesses than certified firms. But lacking an SBA certification doesn’t mean you can’t get your start.2

2025’s changes in goals, priorities, and set-asides

The small-business world has changed in significant ways since the period covered by the newly released scorecard. The biggest change for the 2025 scorecard cycle is that SBA dropped the goal for small disadvantaged business contracting from 15% to 5%. This will lead to fewer 8(a) opportunities in the future—something I’ll dive into in a future article. Already, the effects are showing up in 2025 data. Right now, 9.9% of 2025’s contracting dollars have gone to SDBs (via SAM.gov), well above the 5% goal but less than the 10.7% at this point last year.3

There’s also less concern about the ongoing decline in small-business participation in the industrial base. The FAR Council had proposed to reverse that decline by mandating the use of the Rule of Two on multiple-award contracts. (The Rule of Two triggers a set-aside when at least two small businesses can do the work at a reasonable price.) Last month, the Council withdrew the proposal, citing the Executive Order rescinding Biden-era policies.

Finally, data indicates that the period of set-aside growth might be ending. The Federal government has increased set-aside contract dollars each year since 2014. In the middle of this fiscal year, however, an Executive Order directed agencies to align “contracts (including set-asides)” with Administration policies. Set-asides are now lagging behind their record-setting 2024 pace: 15.7% in 2025 versus 16.3% at this point in 2024. That’s a small drop percentage-wise, less than $3 billion in dollar terms. But it foreshadows that the decade-long growth in set-asides has reached its plateau.

Sam Le is a government contracts lawyer licensed in Virginia and the District of Columbia. His website is samlelaw.com.

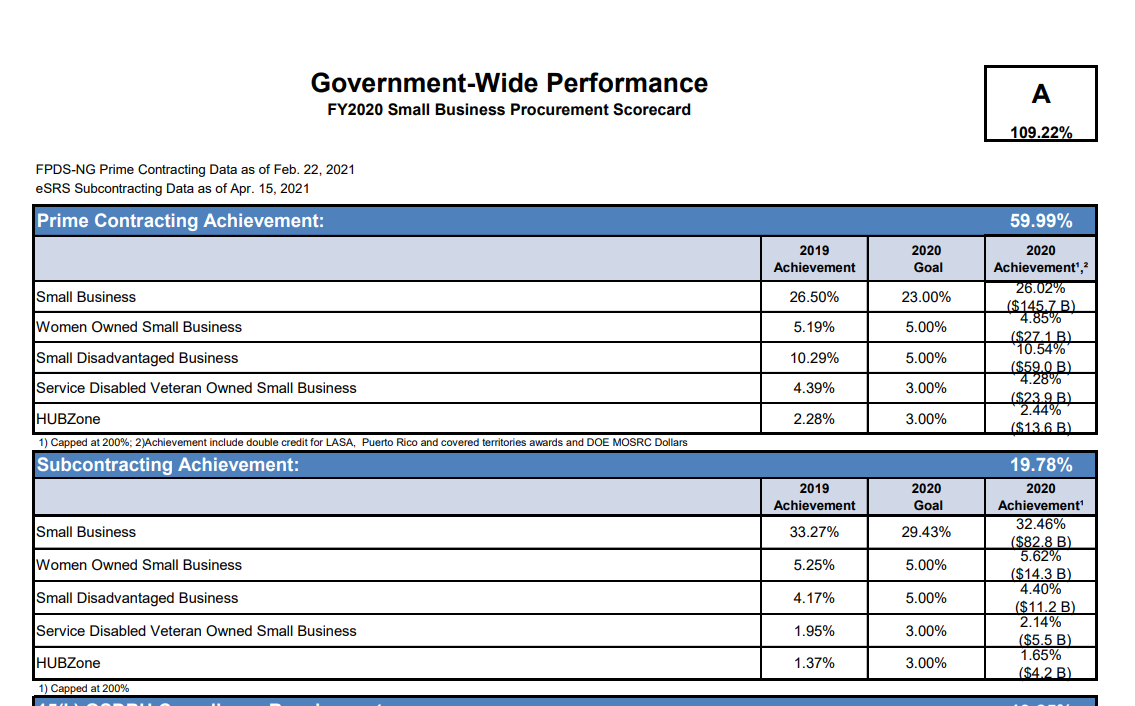

When I started, the scorecard looked like this and was available only in PDF. It’s now interactive and filled with graphs, primarily because of the efforts of SBA’s OCIO.

There is an obscure provision at 13 CFR 121.109 allowing businesses to obtain the equivalent of a small-business certification through SBDC and Apex Accelerators. SBA’s Associate General Counsel for Procurement Law must agree with the SDBC or Apex Accelerator’s opinion. Just to show how old and obscure the provision is, it only provides the fax number for the Associate General Counsel.

That 10.7% figure for FY24 year to date comes from my own calculations, which take into account SAM.gov’s 90-day lag for Department of Defense data. I used the same method for the set-aside calculation.